Not known Facts About Do You Have To Sign Up For Medicare At 65

8 Easy Facts About Medicare Part C Eligibility Explained

Table of ContentsSome Known Details About Shingles Vaccine Cost The 10-Second Trick For Apply For MedicareThe Of Medicare Select PlansThe Only Guide to Medicare Part G

Certified Medicare Beneficiary (QMB) is a Medicaid program for individuals that are already receiving Medicare benefits. The function of the program is to reduce the cost of medications and copays for medical professionals, hospitals, and also medical procedures. The QMB program might vary by state. For the function of this article, we are going over the QMB program as it associates with Florida.

As with all Medicaid programs, QMB has income as well as asset limits that should be fulfilled in order for someone to certify for this program. Advantages of the QMB program consist of: Medicare Component A & B costs paid back in your Social Protection Examine Medicare Part D premium minimized or covered via the Low Income Subsidy (LIS)/ Extra Assistance program Medicine costs reduced to $0 $10 for a lot of medications through the LIS/ Extra Aid program No Donut Opening/ Protection Gap Medicare deductibles paid by Medicaid Medicare coinsurance and also copays within prescribed limitations paid Below is an instance of just how the QMB program can aid somebody: When in the Donut Opening, Insulin can set you back $300 per month.

Fascination About Medicare Supplement Plans Comparison Chart 2021 Pdf

You can likewise reveal a copy of your Medicare Recap Notification. If you're billed, recommend the service provider that you're signed up in the QMB program - medicare supplement plans comparison chart 2021.

It is essential to recognize, nonetheless, that specific amounts of revenue are not counted in figuring out QMB eligibility - what does plan g cover. Specifically if you are still working and a lot of your income comes from your incomes, you might have the ability to certify as a QMB even if your total earnings is nearly two times the FPG.

If, after applying these policies, the figure you arrive at is anywhere close to the QMB certifying restriction (in 2020, $1,083 in regular monthly countable income for a private, $1,457 for a couple), it is worth making an application for it. (The limitations are somewhat higher in Alaska as well as Hawaii.) Possession Purview There is a restriction on the value of the assets you can have and also still certify as a QMB (boomer benefits reviews).

Because the SLMB and QI programs are for individuals with higher revenues, they have less benefits than the QMB program. The SLMB as well as QI programs pay all or part of the Medicare Part B monthly premium, yet do not pay any Medicare deductibles or coinsurance amounts. However, this suggests prospective savings of greater than a thousand bucks each year.

Little Known Facts About Medicare Select Plans.

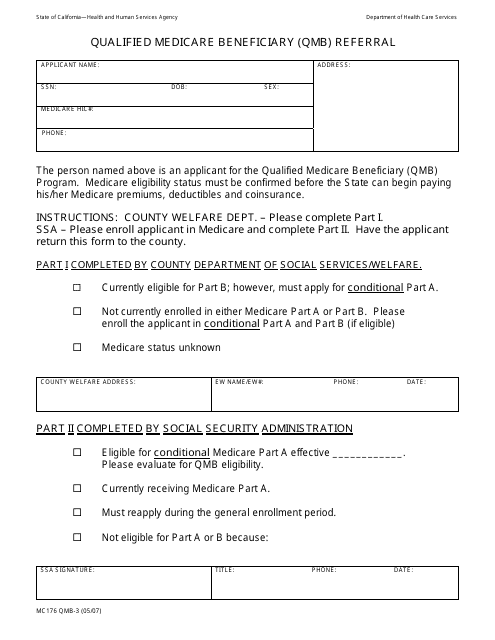

If you are located ineligible for one program, you may still be found eligible for among the others. Where to Submit To receive the QMB, SLMB, or QI programs, you need to submit a written application with the agency that handles Medicaid in your stateusually your area's Department of Social Providers or Social Well-being Department.

A Medicaid qualification worker may need added certain details from you, you will at the very least be able to get the application procedure started if you bring: pay stubs, revenue tax returns, Social Security benefits details, as well as various other evidence of your present income documents showing all your financial savings and various other economic assets, such as bankbooks, insurance policies, as well as stock certifications car enrollment documents if you possess an auto your Social Security card or number details concerning your spouse's income and different properties, if the 2 of you live with each other, and also medical costs from the previous 3 months, as well as medical records or records to confirm any medical condition that will need treatment in the near future.

Inquire about the procedure in your state for getting a hearing to appeal that decision. At a charm hearing, you will certainly have the ability to provide any type of papers or other papersproof of revenue, properties, clinical billsthat you assume sustain your claim. You will also be enabled to describe why the Medicaid choice was incorrect.

You are allowed to have a close friend, loved one, social employee, legal representative, or various other depictive show up with you to assist at the hearing. The precise procedure for getting this hearing, as well as the hearing itself, might be a little different from state to state, they all resemble very closely the hearings given to candidates for Social Safety and security advantages.

The Main Principles Of Medigap Cost Comparison Chart

Getting Support With Your Allure If you are denied QMB, SLMB, or QI, you might intend to seek advice from a person experienced in the based on help you prepare your charm. One place you can find quality cost-free support with these issues is the nearest workplace of the State Medical medigap cost comparison chart Insurance Aid Program (SHIP).